Free the Founder

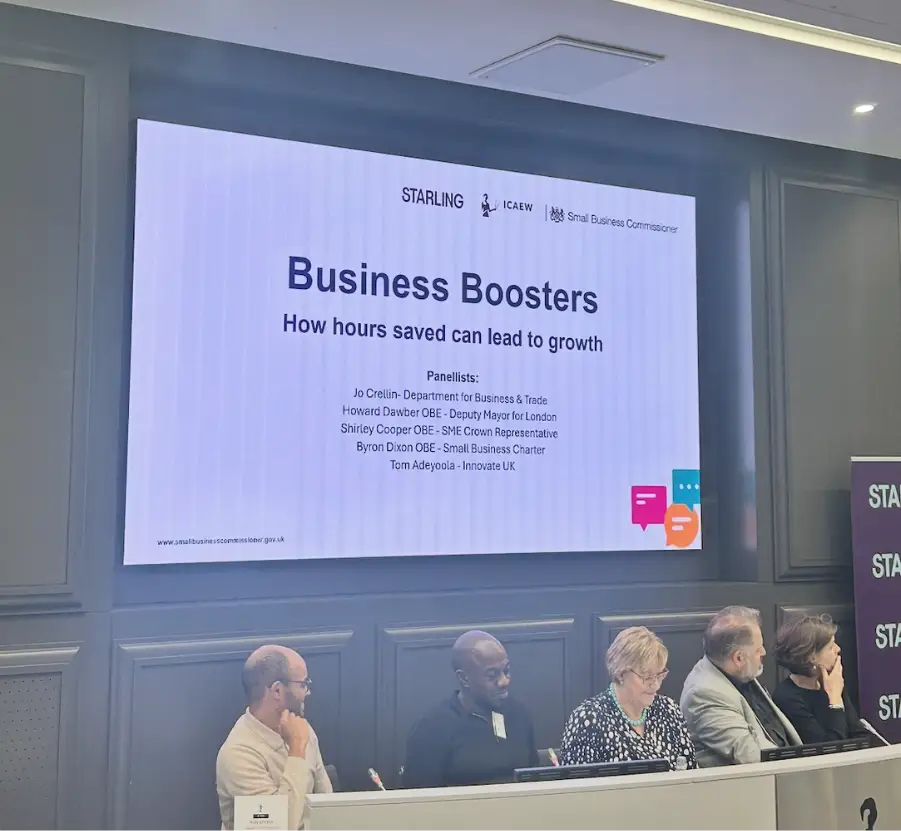

This was the name of the event we hosted on Monday with generous support from Institute of Chartered Accountants in England and Wales (ICAEW) and Starling. A stellar line-up of speakers addressed three questions:

- How do we boost digital adoption in the UK to free up founders?

- What are the benefits of being on the Fair Payment Code?

- With hours freed (as above), how can new-found time go towards growth?

The first panel covered the question of digital adoption. Good news from Rob Burlison of Intuit kicked us off with the latest Small Business Insights showing 7 out of 10 small businesses now use AI regularly; an increase from 48% since July 2024, with daily use having more than doubled over the past 12 months

National Technology Adviser, Dave Smith, wants to see this continue and has made recommendations as such in his Technology Adoption Review, launched as part of the Industrial Strategy. Dave is particularly keen on a ‘CTO as a service’ concept that would support small businesses in deciding which piece of digital kit would have the greatest impact on the business.

Nicola Hodson agreed and outlined how companies like IBM can help realise this vision and, indeed, are working on the job with a commitment to train 30 million people globally by 2030 on the new skills they need for the digital economy.

Entrepreneur Daniel Hogan, who recently sold his business Ember to Starling, outlined how banks and financial providers can free up time through building products that are so effortless that founders don’t have to think. Hailing from Australia, Dan credits HMRC with his decision to move to the UK to start a business as he wanted access to the open infrastructure on which to build quality products for small and micro enterprises.

Next up was Jonathan Lee, Director of Finance & Investment Operations at Aviva, who outlined why his company wanted to join the Fair Payment Code. Aviva process 450,000 invoices per year (wow!) and feel that paying their bills and SME suppliers within 30 days is simply the ‘right thing to do.’ We could not agree more. Thank you, Jonny, for sharing your journey, which will inspire other large financial institutions to follow suit.

After some caffeine (thank you again ICAEW), we were back for talk of growth, growth, growth.

Joanna Crellin, Director General from the Department for Business and Trade confirmed government’s intent and agenda as set out in the Small Business Plan launched on 31 July, covering areas from high street regeneration to access to finance and exports. Jo came to the event hot on the heels of a meeting with the new Secretary of State who shares a commitment to delivery of the Plan.

Deputy Mayor of London for Business, Howard Dawber OBE, is a man on a mission and is happy with progress made via support programmes Grow London Local and Grow London Global that are engaging thousands of London firms and helping them to thrive. Should any of these firms sell to the Greater London Authority, they will get paid within 10 days, and Howard wants to see more of them, with his next project being procurement and an intent to spend more of London’s £billions with SMEs.

Shirley Cooper OBE is already on the job as the UK’s SME Crown Representative. The new Procurement Act came into force in February 2025 and Shirley has since championed the training of 36,000 government commissioners in how to ‘give regard’ to small firms when buying. Shirley is now working with central government departments to set their respective SME spend targets.

Byron Dixon OBE has found the time to grow his own business, Micro Fresh, with sales to John Lewis, Next, and increasingly overseas. He is an evangelist for founders working ‘on’ the business not ‘in’ the business, with this having benefited his own venture when he went through the Goldman Sachs 10,000 programme. Whilst overseeing continued company expansion, Byron also Chairs the Small Business Charter and travels the UK encouraging businesses to join the Help to Grow Management programme.

Last but by no means least was former entrepreneur and now CEO and Exec Chair of Innovate UK, Tom Adeyoola. Since starting his new and significant role in April, Tom has developed a vision to accelerate innovation in the UK and ensure stealth companies have a path to staying owned and operated here. Everyone in the room felt inspired by his words and intent.

Small business champion, Iain Wright, closed off proceedings saying he felt positive about what he had heard, and stressed the role accountants can play in boosting confidence and business.

In summary, if we can do the job of leveraging tech to reduce hours that small businesses spend on non-productive tasks like chasing debt, there are ample opportunities that can take those hours and re-focus them on growth.

Thank you ICAEW and Starling for your support, to the amazing speakers, and to a wonderful audience for your questions and contribution.

Now to make it happen!