Payment Practices and Performance reporting and how it’s supporting small firms

As a small business, you will likely never have heard of the payment practices and performance reporting but I’m introducing it in this week’s newsletter, as being aware of what it is can help you check payment performance of your existing and potential clients and suppliers in order to make more informed decisions as to whether you want to do business with them.

What is the reporting?

Large companies of a certain size have a legal duty to publicly report their payment practices and performance. Requirement to report is for companies that meet 2 or all of these criteria; £54 million annual turnover, £27 million balance sheet total, 250 employees.

In terms of what the companies have to report, it is; average number of days taken to make payments in the reporting period, the percentage of payments made within the reporting period which were paid in 30 days or fewer, between 31 and 60 days, and in 61 days or longer, and the percentage of payments due within the reporting period which were not paid within the agreed payment period.

Organisations are required to report twice a year.

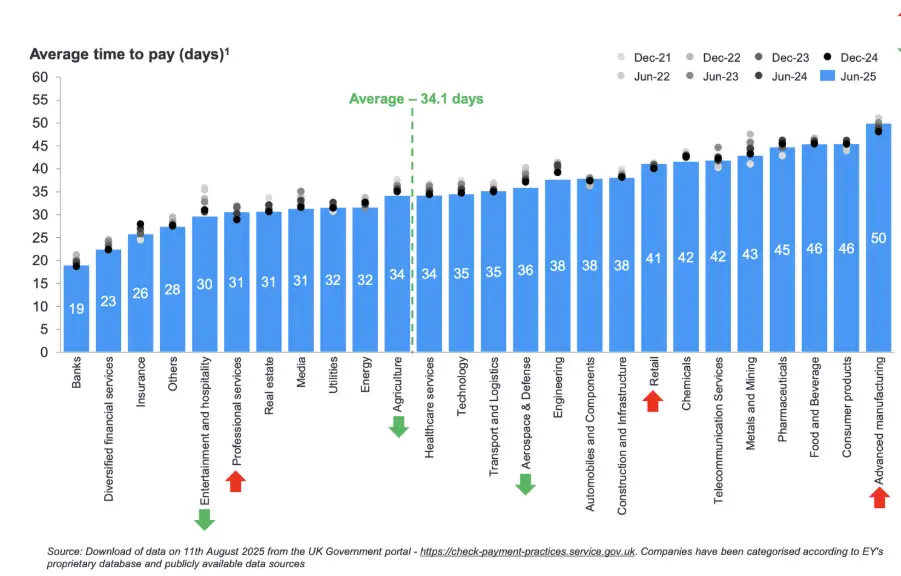

There are currently just over 5,000 organisations reporting and, sourced via data compiled by EY, you can see average days to pay according to key sectors.

How is the data being used to support small firms?

Government is using the publicly available data in some key ways:

- To identify organisations not reporting who come within eligibility criteria and contacting them to confirm their duty to report

- Requesting payment performance data be included when bidding for public sector contracts as evidence of prompt payment through the supply chain

- My own office is accessing the data to a) identify the best in class payers and sending letters directly to finance leads at the companies that should qualify for a gold award of the Fair Payment Code (paying 95% of suppliers in 30 days) and asking them to apply to the Code, and b) identifying the not so good payers to bring to their attention the current consultation on prompt payment measures that could see a tightening of treatment towards large organisations who are repeatedly paying late.

How can a small business access and use the data?

Anyone can access data on payment performance via this link > https://www.gov.uk/check-when-businesses-pay-invoices

From here you can check payment performance of your clients and the companies from whom you buy your business essentials e.g. banks, telecom companies etc as well as from whom you buy life’s essentials such as houses!

A major step in addressing a problem like late payment is to publicly see the size of the problem and with this transparency in reporting, it gives us a much clearer picture on where effort should be focused.