How a target focused minds to paying SMEs in less than 10 days

It all started with a tweet.

Okay, so I know they are not called tweets anymore but on 11th July Deputy Mayor of London for Business, Howard Dawber OBE, posted on X that the Greater London Authority (GLA) was paying its SME suppliers at lightning speed. He offered for others to ask how this had come about and tagged the Office of the Small Business Commissioner.

I went to find out more.

With thanks to the Deputy Mayor and his team for meeting me, outlining how they got to such admirable payment times, and for agreeing to be interviewed for this newsletter, with answers that I hope will be read by other large organisations, in the public and private sector, as they come complete with tips on how to get to a happy state of prompt payment.

Why is paying small firms on time important to you?

The London Growth Plan – created by partners across London – has small businesses at its core. There are around a million small businesses in London, accounting for 99.8% of all businesses in the capital. We want to help Micro, Small and Medium-sized Enterprises (MSMEs) enter the supply chain to support their ambitions, and have set out plans in our Responsible Procurement Policy.

We have huge buying power but it’s not just the value of the contracts we offer; it’s fairness and transparency in how we work, providing small businesses with certainty and confidence. We want to make it easier for SMEs to bid for contracts from London’s public-sector organisations and ensure they have a positive experience.

A key part of that is making payment on time, helping companies to predict, manage and smooth income. This is especially important given smaller enterprises’ challenges around cash flow; a key barrier to SME growth is overdue payments and long payment terms. By paying promptly, we can attract more small suppliers to work with us and show other companies that this target can be achieved.

What was the target you set out to achieve?

The Mayor set us a challenge to pay 90% of undisputed SME invoices within 10 days.

This means we have to set up SME vendors on our system and make the payment within this time frame.

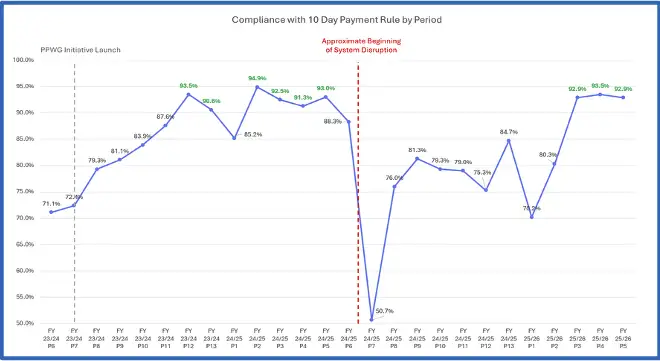

Performance is closely monitored and when we could see performance notably dropping, we formed the SME prompt payment working group (PPWG), to identify system issues and other reasons for slow and missed payments.

Can you share the measures you had to take to start reducing payment times?

The PPWG wanted to understand the key issues and work with stakeholders on new ideas and communications to improve performance. There was a thorough investigation, including meetings with internal teams to gain insight of their experiences and issues.

There were some technical issues – for example we needed to close SAP legacy purchase orders and migrate them to the new SAP Ariba system. But much of it was behavioural. We undertook regular communication to change culture and ensure everyone is proactively actioning SME invoices and taking accountability for their performance. Some of it was really simple – we highlighted the need to have delegation when on leave – and some was about educating teams on why paying suppliers on time matters.

How did you bring the team with you on this journey?

We needed to increase awareness about why paying SMEs on time was critical to economic and social growth. Our CFO sent a letter to the organisation about performance, noting that there would be more attention and scrutiny.

As part of the engagement strategy, we mechanised a daily notification system to alert requisitioners, approvers, Cost Centre Managers and assistant directors to live and missed, parked, and blocked invoices and the required action. Reports to highlight the periodic performance were shared with assistant directors, helping everyone to understand their role in achieving the target.

We conducted targeted outreach with specific GLA teams to identify the pain points and ensured responsiveness to the issues raised. There were several drop-in training sessions to increase awareness about the SME invoice payment process.

Earlier this year we launched awards for team members to recognise them for their services to prompt payment processing – we even had an awards ceremony with trophies! (see image above) This was a fun way to celebrate the coordinated efforts of teams and individuals.

Can you share your current payment performance?

The GLA achieved its goal of paying 90% of SME invoices in 10 days for period 12 and 13 of the fiscal year 2023/2024 and again for four consecutive periods from period 2 to period 6 2024/25. Unfortunately, the performance from Period 7 that year was severely impacted by the cyber incident affecting TfL and ongoing recovery.

Following the increased focus, the GLA successfully achieved the target from Period 3 2025/26. This has continued, with Period 6 performance at a high of 94.9%.

What has been the feedback from small firms?

Feedback from some SME suppliers is provided below (the names redacted for privacy).

“Prompt payment of our invoices is greatly appreciated and valued at U Ltd. As an SME, timely invoice settlement supports cashflow and therefore the productivity of our company… it is invaluable when clients like GLA support us by taking this approach to our working relationship by proactive invoice management”

“The system works excellently… it very reliably pays invoices within 10 days. This is really excellent for me and my small business, to know reliably that the invoice will be paid and when, and in 10 days rather than the usual 30 days (and often longer than this). It’s very efficient. I wish all my clients were like this!”

“I am very happy with the payments received on the invoices we submit. It is reassuring to know that payment will be received within my terms of business and usually is paid sooner. It means I can confidently plan my cashflow.”

What would be your advice to other organisations of a similar size who want to do the right thing and pay within 30 days?

We encourage other organisations to begin with a commitment to pay SMEs within 30 days and work to shortening this to 15 or 10 days. A clear benchmarking target and robust reporting with accurate data is critical.

It’s vital to establish stakeholder buy-in and support them with a team of subject matter experts who are passionate and committed to delivering the performance improvements. It’s a gradual journey as changes take time to roll out and be embedded: the team needs to proactively monitor and review the results and be flexible to adapt the strategy to changes and developments.

Now you’ve achieved this target – what next?

We have received significant interest from other members of the GLA Group that have the same 10-day target, who are looking at any improvements they might make. We’re pleased there’s also interest from London Anchor Institutions’ Network members – a London initiative bringing together large organisations who collectively have huge buying power. Many don’t yet have this target, but want to learn more.

There are wider actions in our Responsible Procurement Delivery Plan too, which are focused on how we can better open up public sector supply chains to micro, small and medium enterprises, and companies with diverse ownership.

The greatest impact we can have is to encourage our suppliers to learn from us and consider prompt payment of SME invoices in their own supply chain.

Thank you again, GLA, for agreeing to share your journey.